Trevor Greetham is an investment strategist and fund manager with 24 years of experience. Prior to joining Royal London in 2015, Trevor was Asset Allocation Director for Fidelity Worldwide Investment, where he was responsible for implementing tactical investment decisions across a wide range of institutional and retail funds. From 1995 to 2005, Trevor was Director of Asset Allocation for Merrill Lynch, advising fund manager clients on their multi asset investment strategy. Trevor qualified as an actuary with UK life assurer Provident Mutual and has a Master of Arts in Mathematics from Cambridge University.

Trevor Greetham

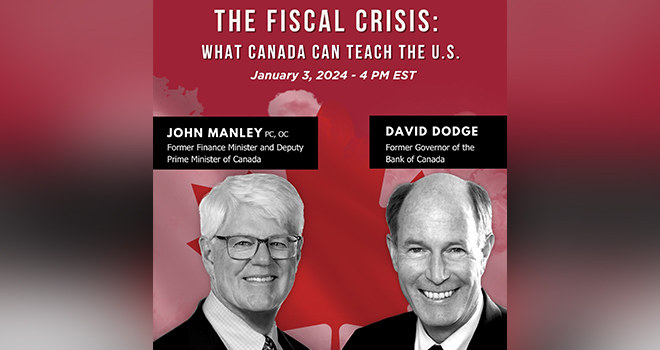

The Honourable John Manley, P.C., O.C., became Chair of Jefferies Financial Canada on December 1, 2023, having served as Senior Business Adviser at Bennett Jones LLP since September 2019. He is best known as a former Deputy Prime Minister of Canada. He served in the Canadian Parliament from 1988 to 2004 as M.P. for Ottawa South. From 1993 to 2003 he was a Minister in the governments of Prime Minister Jean Chrétien, serving in the portfolios of Industry, Foreign Affairs and Finance, in addition to being Deputy Prime Minister.

Following the terrorist attacks of September 11, 2001, Mr. Manley was named Chair of a Cabinet Committee on Public Security and Anti-terrorism, serving as counterpart to Governor Tom Ridge, the first U.S. Secretary of Homeland Security. In recognition of the role he played following 9/11, which he refers to as his “moment of fame”, TIME Canada named him “2001 Newsmaker of the Year” (and gave him some free copies of the magazine).

After a 16-year career in politics, Mr. Manley returned to the private sector in 2004 where he has continued to be active in public policy, as a media commentator, speaker and adviser to governments of differing political stripes. He is Fellow of the CD Howe Institute, the Royal Canadian Geographic Society, and the Institute of Corporate Directors. He is a founding member of the Wilson Center Global Advisory Council, a past member of the Brookings Institution International Advisory Council and served as Chair of the Canadian Global Affairs Institute (CGAI) Advisory Council from 2012-2023. He joined the Advisory Council of the MacDonald Laurier Foundation in 2023.

——————————————————————————————————

During a distinguished career in the federal public service, Mr. Dodge held senior positions in the Central Mortgage and Housing Corporation, the Anti-Inflation Board, and the Department of Employment and Immigration. After serving in a number of increasingly senior positions at the Department of Finance, including that of G-7 Deputy, he was Deputy Minister of Finance from 1992 to 1997. In that role, he served as a member of the Bank of Canada’s Board of Directors.

In 1998 he was appointed Deputy Minister of Health, a position he held until his appointment as Governor of the Bank of Canada.Mr. Dodge, appointed Governor of the Bank of Canada, effective 1 February 2001 for a term of seven years, retired on 31 January 2008. From July 2008 to June 2014, he served as Chancellor of Queen’s University. From 2009 to 2015, he was a member of the board of directors of Canadian Utilities Limited, ATCO Limited and the Bank of Nova Scotia.

Mr. Dodge is Senior Advisor at Bennett Jones LLP one of Canada’s leading law firms. He also serves on the board of the Canadian Institute for Advanced Research, and Chairs the National Council of the C.D. Howe Institute.

John Manley and David Dodge

A leading authority on China’s economy and financial system, Leland is the co-founder and CEO of China Beige Book International. Leland is a frequent commentator on media outlets such as CNBC, Bloomberg TV & Radio, CNN, BNN, BBC, and FOX Business, and he has served as a guest host of two of the financial world’s top morning news shows, CNBC Squawk Box and Bloomberg Surveillance. His work is featured regularly in the Wall Street Journal, New York Times, Washington Post, TIME, New Yorker, The Atlantic, Forbes, Foreign Policy, The Hill, and South China Morning Post. Before co-founding China Beige Book in 2010, Leland was a capital markets attorney based out of New York and Hong Kong and worked on the deal team at a major investment bank. He holds a law degree from the University of Virginia School of Law, where he was Hardy C. Dillard fellow and editor-in-chief of the International Law Journal; a master’s degree in Chinese History from Oxford University; a BA in European History from Washington & Lee University; and a graduate Chinese language fellowship from Tunghai University (Taiwan). Leland is an elected member of the National Committee on U.S.-China Relations and Economic Club of New York, an elected life member of the Council on Foreign Relations, a board member of the Global Interdependence Center, and a non-resident Senior Fellow at the Brent Scowcroft Center on International Security at the Atlantic Council.

Leland Miller

For over 30 years Lakshman Achuthan has been studying business cycles and working with clients to help them manage risks and opportunities around turning points. In 2004, he co-authored Beating the Business Cycle: How to Profit from Turning Points in the Economy. Lakshman met his mentor, Geoffrey H. Moore, at Columbia University in 1990. After working together for years, with co-founder Anirvan Banerji, the three left Columbia to start ECRI in 1996. He also serves on the Board of Governors for the Levy Institute of Economics of Bard College.

Lakshman Achuthan

Stephanie Pomboy is founder and president of MacroMavens, a boutique research firm that provides macroeconomic research and commentary to an exclusive swath of the institutional investment community. The firm takes an unconventional approach to economic analysis, eschewing the typical over-emphasis on short-term swings. Instead MacroMavens endeavors to identify major macro trends and to flesh-out the market risks/opportunities around them. Since its inception in 2002, the firm has earned a reputation for calling major macro developments well ahead of the curve. Stephanie was one of the few warning of the housing bubble’s bust — and a lone voice in identifying the inexorable hit to financials to follow.

Stephanie Pomboy

Peter is Chief Investment Officer of Bleakley Financial Group. In his role as CIO, Peter leads the team that is responsible for the development, management and oversight of Bleakley’s investment management program, managing the investment committee, and setting the firm’s overall investment philosophy, global investment outlook and asset allocation decisions. He also manages two internal portfolio strategies. Peter is also a CNBC contributor and Editor of The Boock Report.

Peter Boockvar

Mike Rothman is the President and Founder of Cornerstone Analytics, a macro-energy research firm that analyzes key market fundamentals involving supply, demand and geopolitics that influence the price of energy commodities and investment instruments. Mike previously founded ISI’s energy research platform in 2005, where he was #1 ranked for Independent Energy Research by Institutional Investor Magazine. Prior, Mike was Chief Energy Strategist and Co-Head of the Global Energy Equity Team at Merrill Lynch, which was ranked #1 in the Global Research Survey by Institutional Investor Magazine. With 37 years of researching the global energy markets and 35 years of attending OPEC meetings, Mike has forged deep industry contacts and cultivated unmatched insights that are relied upon by clients that include asset managers, commodity traders, oil companies, OPEC nations, and government organizations. Mike is a frequent guest speaker on Bloomberg and CNBC, a contributor to leading financial publications, and a keynote speaker at industry conferences around the globe. Cornerstone Analytics publishes a daily report and helps clients with research requests through email, conference calls, and in-office visits.

Michael Rothman

A. Gary Shilling, Ph.D., is President of A. Gary Shilling & Co., Inc., investment advisers, economic consultants and publishers of INSIGHT, a monthly report of economic forecasts and investment strategies. Dr. Shilling is a columnist for Bloomberg View online, a Forbes magazine columnist since 1983 and a frequent contributor to the financial media.

He received his bachelor’s degree in physics, magna cum laude, from Amherst College where he was also elected to Phi Beta Kappa and Sigma Xi. Dr. Shilling earned his master’s degree and doctorate in economics at Stanford University. While on the West Coast, he served on the staffs of the Federal Reserve Bank of San Francisco and Bank of America. Earlier, as a high school senior, he ranked 12th in the nation in the Westinghouse Science Talent Search.

Before establishing his own firm in 1978, Dr. Shilling was Senior Vice President and Chief Economist of White, Weld & Co., Inc. Earlier, he set up the Economics Department at Merrill Lynch, Pierce, Fenner & Smith at age 29 and served as the firm’s chief economist. Prior to Merrill Lynch, he was with Standard Oil Co. (NJ) (now ExxonMobil).

He has written eight books on the economic outlook and investment strategy.

Twice, the Institutional Investor magazine ranked Dr. Shilling as Wall Street’s top economist, Futures magazine rated him the country’s number one Commodity Trading Advisor and MoneySense magazine named him the third best stock market forecaster in the world, right behind Warren Buffett. He is recognized as an effective and dynamic speaker.

He is Chairman of the Episcopal Preaching Foundation, which he founded in 1988, and is an avid beekeeper.

Gary Shilling

Joseph (Joe) LaVorgna is a Managing Director and Chief Economist for SMBC Nikko Securities America, Inc. Joe joined the firm in September 2022 and is based in New York.

Joe has spent more than 25 years in the financial services industry. He was most recently Managing Director and Chief Economist for the Americas at Natixis, where he oversaw the firm’s economic research effort in the region and managed a team of economists who analyzed trends in the equity, fixed income, foreign exchange, and commodity markets.

While with Natixis, Joe spent one year serving at the White House as Special Assistant to the President and Chief Economist of the National Economic Council.

Prior to Natixis, Joe spent 20 years with Deutsche Bank Securities in the Global Market Division, where he was considered one of the leading Wall Street economists. Early in his career, he was with Lehman Brothers, Inc., UBS Securities, Inc., and the Federal Reserve Bank of New York.

Appearing regularly in the financial media, Joe has been a contributor for CNBC and a contributing opinion writer for The Hill. For more than a decade, he was also ranked as a top economist in the prestigious Institutional Investor All-Star Fixed Income Survey.

Joe also holds a Senior Fellow position at the America First Policy Institute, a Washington, D.C.-based think tank.

Joe earned a Bachelor of Arts in economics from Vassar College and did graduate work in economics at New York University.

Joseph LaVorgna

Dana Telsey is the CEO and Chief Research Officer of Telsey Advisory Group (TAG). TAG’s research team covers U.S. and international companies across all market caps in the following sectors: apparel manufacturers, children’s and teen retailers, consumer electronics retailers, cosmetics, department stores, discounters, footwear, gaming and lodging, home furnishings retailers, home improvement retailers, internet, luxury goods, office supply retailers, off-price retailers, restaurants, specialty apparel retailers, sporting goods retailers, and supermarkets.

Founded in 2006, TAG has grown to be a leading equity research, trade execution, investment banking and consulting firm, focusing on the consumer space. TAG is also certified as a Woman-Owned Business Enterprise by several states, cities, the Women’s Business Enterprise National Council and numerous plan sponsors across the country. In 2015, Ms. Telsey also formed Telsey Consumer Fund Management LP, an asset management firm that manages a long/short hedge fund investing in consumer-based companies. Ms. Telsey has followed over 100 companies during her 34-year career and is the only U.S. based analyst to provide complete analysis of the European luxury goods sector.

From 1994 to 2006, she was at Bear, Stearns & Co. Inc. covering the retail sector as a Senior Managing Director. Prior to working at Bear Stearns, Ms. Telsey was the Retail Analyst at C.J. Lawrence and Vice President of the Baron Asset Fund at Baron Capital, Inc. In 2018, Ms. Telsey was elected to the International Council of Shopping Center’s (ICSC) Board of Trustees for an initial three year term. In 2016, Ms. Telsey won the Thomson Reuters award for “Number 1 Stock Picker for Multiline Retail”. In 2015, Ms. Telsey was selected, “from hundreds of nominees by the National Retail Federation (NRF) executive judging panel of top industry CEOs”, as one of the 24 winners of The List of People Shaping Retail’s Future. In 2014, Ms. Telsey was honored with the designation of Woman- Owned Brokerage of the Year by Traders Magazine for successfully growing her firm by developing and delivering top-notch research and trading tools. In 2011, Traders Magazine awarded her as Entrepreneur of the Year. Ms. Telsey is a thirteen-year member of Institutional Investor magazine’s “All-America Research Team” where she was ranked the Number One Specialty Stores analyst for seven consecutive years through 2005. Ms. Telsey is a regular guest analyst on both CNN and CNBC and has appeared as a special guest on such programs as Bloomberg Radio, World News Tonight – ABC News, Good Morning America, The NBC Evening News, The Today Show, BNN, and BBC amongst many others. Ms. Telsey graduated from Hobart-William Smith Colleges with a B.A. degree in History and Spanish and received her M.B.A from Fordham University.

Dana Telsey