Managing wealth and investments requires more than just market knowledge—it demands a strategic approach rooted in economic insights. While the financial landscape can be complex and ever-changing, working with an expert can provide the clarity needed to make informed decisions. A professional advisor offers more than just portfolio management; they provide data-driven strategies that align with economic trends, risk assessments, and long-term financial stability.

This article explores the benefits of working with a financial advisor, how economic expertise enhances financial planning, and key considerations when selecting the right professional for your needs.

The Economic Advantage of Financial Advisors

One of the strongest reasons to engage a financial advisor is the potential for better investment outcomes through expert analysis and strategic decision-making. Research indicates that investors who work with professionals often achieve higher returns—sometimes up to 15% more over a decade—compared to those managing assets independently. This advantage stems not just from market experience but from applying economic principles to investment strategies, ensuring portfolios are positioned for sustainable growth.

Advisors offers personalized financial guidance that adapts to your specific goals and economic conditions. Whether planning for retirement, optimizing asset allocation, or navigating tax implications, an advisor takes a comprehensive approach based on macroeconomic trends and personal financial objectives. Their ability to interpret economic indicators—such as inflation trends, interest rate shifts, and market cycles—provides clients with an edge in wealth preservation and long-term planning.

Strategic Planning for Long-Term Stability

A financial advisor’s role extends beyond reacting to market fluctuations; they help create a proactive, structured financial strategy. This involves evaluating economic shifts, adjusting portfolios accordingly, and ensuring investment decisions align with broader financial objectives. Rather than focusing solely on short-term gains, advisors develop plans that consider tax efficiency, wealth transfer, and risk mitigation—critical elements in long-term financial security.

Confidence in financial planning is another key benefit. Studies show that 70% of investors who work with an advisor feel more secure about their financial future. This assurance stems from having an expert who understands not just market movements but the economic forces driving them.

Managing Uncertainty with Data-Driven Insights

Market downturns and volatility can trigger emotional decision-making, often leading investors to react impulsively. However, advisors help maintain discipline by applying data-driven strategies rooted in economic fundamentals. In fact, clients who work with professionals are 2.5 times more likely to stay invested during market downturns, avoiding costly mistakes driven by short-term uncertainty.

By integrating economic expertise with financial advisory services, clients gain a well-rounded strategy that enhances stability, mitigates risk, and fosters sustainable growth. As we explore further, we’ll examine how economic insights shape financial decision-making and ensure long-term financial success.

Expertise in Financial Planning

Financial planning extends beyond investment management, encompassing budgeting, tax strategies, risk management, and long-term wealth preservation. A structured approach ensures financial decisions align with both personal goals and broader economic conditions. Working with a Certified Financial Planner (CFP) provides clarity in navigating these complexities.

A key aspect of financial planning is debt management, ensuring high-interest liabilities are addressed efficiently. Additionally, strategic financial planning includes establishing savings for future expenses, such as education or unforeseen emergencies. These foundational steps contribute to long-term financial security.

Beyond asset growth, financial advisors focus on risk mitigation and adaptability. Economic shifts, career transitions, and unexpected expenses require adjustments to financial strategies. Studies show that individuals who work with advisors report a 70% increase in financial confidence, leading to more decisive action and improved financial stability.

When evaluating financial advisors, it is essential to assess their expertise in integrating economic insights into financial planning. Next, we examine how investment advisors tailor strategies to help clients navigate market complexities.

Role of Investment Advisors

Investment advisors develop portfolio strategies that align with individual risk tolerance, market conditions, and long-term financial objectives. By analyzing financial trends and economic indicators, they create investment plans designed for both growth and resilience against market fluctuations.

A diversified portfolio, balancing stocks, bonds, and real estate, mitigates risk while maximizing returns. Without expert guidance, many investors struggle to navigate investment options and may base decisions on short-term trends rather than sound economic principles.

Investment advisors provide market expertise, helping clients make informed decisions based on data rather than emotion. While robo-advisors offer algorithm-driven recommendations, they lack the ability to adapt strategies to individual financial circumstances. During market downturns, an experienced advisor offers guidance to prevent reactive decisions that could hinder long-term growth.

An important factor to consider when selecting an investment advisor is their compensation structure, as it directly impacts the services provided and the alignment of their recommendations with a client’s best interests. Understanding this dynamic ensures transparent, value-driven financial guidance.

Essential Advisor Credentials

Understanding a financial advisor’s credentials is crucial when evaluating their expertise. Some designations carry more weight in the industry, with Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA) being among the most respected. These certifications require extensive education, rigorous examinations, and real-world experience, ensuring advisors possess the knowledge necessary for sound financial guidance.

The CFP designation covers key financial areas, including taxes, estate planning, retirement, and investment strategies. Earning this credential requires completing a comprehensive coursework, passing a challenging exam, and accumulating at least 6,000 hours of professional experience. Additionally, CFP professionals must adhere to strict ethical standards, ensuring they act in the client’s best interests.

The CFA designation focuses on investment management, requiring candidates to pass three intensive exams that assess expertise in portfolio management, financial analysis, and market trends. This credential reflects a high level of analytical skill and a commitment to staying current with financial developments.

Other Professional Certifications

Chartered Financial Consultant (ChFC): Similar to CFP but with a stronger emphasis on practical applications.

Certified Investment Counselor (CIC): Designed for investment management professionals, requiring extensive experience and adherence to ethical standards.

While credentials indicate technical competence, they should be one factor in your evaluation. An advisor’s ability to communicate effectively and align strategies with your financial goals is equally important for a successful partnership.

Strengthening Your Advisor Relationship

A successful partnership with your financial advisor relies on clear, two-way communication. Both you and your advisor play a role in keeping each other informed, ensuring trust, alignment, and smarter financial decisions.

Key Strategies for Effective Communication

Schedule Regular Reviews: Set quarterly or bi-annual meetings to stay updated on financial plan adjustments, market shifts, and personalized investment strategies.

Be Transparent About Goals: Clearly communicate your financial objectives and concerns to help your advisor provide tailored guidance.

Ask for Clarification: Request detailed explanations of investment recommendations to build confidence and understanding.

Update on Life Changes: Inform your advisor of major events—such as a job change, unexpected expenses, or retirement planning—that could impact your financial strategy.

Good communication isn’t just about sharing information—it’s about ensuring mutual understanding. Regular check-ins allow for strategy refinement, market trend analysis, and financial progress tracking.

Maintaining an open dialogue with your advisor leads to more informed decisions and better financial outcomes. If you’re ready to optimize your investment strategy, reach out today.

Strengthen Your Risk Management with Actionable Economic Insights

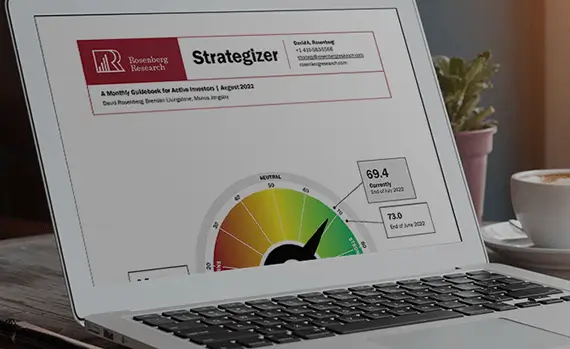

Effective risk management isn’t just about reacting to market volatility—it’s about anticipating economic shifts before they impact your portfolio. At Rosenberg Research, we equip financial professionals with real-time macroeconomic analysis and forward-looking risk assessments, helping you make informed decisions in an uncertain world.

Whether it’s navigating inflation trends, interest rate movements, or global economic shifts, our research provides the clarity and confidence needed to mitigate risks and seize opportunities. Stay ahead of the curve —integrate our insights into your risk management strategy, check our free trial today.