In today’s rapidly shifting economic landscape, making informed business decisions requires more than intuition—it demands a clear understanding of macroeconomic fundamentals. Indicators such as GDP growth, inflation rates, and employment trends are not just abstract figures; they provide critical signals that help organizations align strategy with market realities. Whether evaluating expansion opportunities, adjusting pricing models, or managing operational risk, businesses that integrate macroeconomic data into their planning processes are better positioned to anticipate disruptions and act decisively.

This article explores how data-driven economic insights inform strategic choices and why embedding macroeconomic awareness into decision-making frameworks is essential for sustainable growth, financial resilience, and long-term competitiveness.

The Importance of Macroeconomic Data in Business

Macroeconomic data is more than just background noise—it serves as a foundational input in shaping sound business strategies across industries. In an environment marked by global volatility and rapid market shifts, reliable economic indicators offer businesses a structured lens through which to assess risks, allocate capital, and seize growth opportunities.

Indicators such as GDP growth, inflation trends, labor market conditions, and interest rate shifts provide critical context for understanding the broader economic climate. For example, sustained GDP expansion typically correlates with rising consumer demand, supporting investment in new product lines or geographic expansion. Conversely, elevated inflation may prompt a reassessment of pricing strategies and cost structures to safeguard margins and maintain customer affordability.

Timely interpretation of these indicators allows businesses to respond proactively—not reactively—to market changes. Whether navigating rate hikes by central banks, geopolitical disruptions, or regulatory shifts, organizations equipped with macroeconomic intelligence are better positioned to refine operational budgets, manage credit exposure, and align investment timing with economic conditions.

Importantly, integrating macroeconomic analysis into business planning enhances both resilience and profitability. It fosters a culture of strategic foresight, where decisions are grounded in empirical evidence rather than short-term sentiment. This level of preparedness enables companies to remain agile during economic downturns, capitalize on growth cycles, and strengthen their competitive positioning.

Just as seasoned navigators rely on data to chart a safe course, high-performing businesses leverage macroeconomic insights to steer through uncertainty with greater confidence. In a financial landscape where conditions evolve rapidly, using structured economic analysis isn’t optional—it’s essential for long-term success.

Key Macroeconomic Indicators: GDP, Inflation, and Interest Rates

Understanding key macroeconomic indicators is essential for businesses navigating strategic planning, investment decisions, and risk management. Among the most critical metrics are gross domestic product (GDP), inflation rates, and interest rates—all of which serve as foundational signals of economic health and directional market shifts.

Gross Domestic Product (GDP): A Barometer of Economic Activity

GDP measures the total market value of all goods and services produced within an economy over a specified period. It is one of the most closely watched indicators of economic vitality. A rising GDP signals robust economic activity, often translating into greater consumer demand and increased business confidence. In this environment, companies may pursue growth initiatives—expanding product lines, investing in capital expenditures, or entering new markets.

Conversely, slowing or contracting GDP figures may reflect weakening demand, triggering more cautious approaches. Businesses facing such conditions may reduce discretionary spending, delay hiring, or reassess capital-intensive projects. Monitoring GDP trends allows decision-makers to calibrate operational strategies in step with broader macroeconomic cycles.

Inflation: Gauging Purchasing Power and Cost Pressures

Inflation, typically measured by changes in consumer price indices, reflects the rate at which the general price level of goods and services rises over time. Moderate inflation—often targeted at 2–3% by central banks—can support economic growth. However, when inflation exceeds this threshold, it begins to erode real purchasing power and squeeze profit margins.

In high-inflation environments, businesses must navigate rising input costs and shifting consumer behavior. Strategic pricing adjustments, supply chain diversification, and value-based product positioning become essential tools for maintaining margins and customer retention. On the other hand, deflation or extreme inflation (e.g., hyperinflation) introduces volatility that can disrupt demand forecasting, capital planning, and financial stability.

Interest Rates: The Cost of Capital and Credit Availability

Interest rates, set by central banks, influence the broader cost of borrowing and lending within the economy. Lower interest rates generally encourage business investment and consumer spending by reducing financing costs. This can create favorable conditions for expansion—whether through upgrading infrastructure, funding R&D, or executing growth-oriented acquisitions.

However, rising interest rates signal tightening monetary policy, often in response to inflationary pressures. For businesses, this increases the cost of capital and can dampen investment appetites, particularly for leveraged projects. Strategic debt management and liquidity planning become critical in such periods.

Predicting and Responding to Market Trends

Anticipating market fluctuations is essential for institutions seeking to allocate capital and manage risk effectively. Predictive models grounded in macroeconomic data—such as GDP growth, inflation trends, and consumer sentiment—offer decision-makers a structured framework for identifying potential inflection points in the economic cycle.

Rather than relying on surface-level data, strategic planning demands a rigorous examination of underlying economic indicators. Recognizing these patterns enables institutions to prepare for both emerging risks and opportunities, ensuring decisions are aligned with the broader economic environment.

Sensitivity Analysis

Sensitivity analysis is a core technique in macroeconomic risk assessment. It allows firms to quantify the impact of changes in key variables—such as interest rates, inflation, or employment—on their financial outcomes. For instance, if a 1% increase in inflation correlates with a 2% drop in discretionary sales, strategic adjustments can be made in advance to protect margins.

In sectors sensitive to consumer demand, such as luxury goods or retail, analyzing how economic shocks affect revenue informs more disciplined budget planning, pricing strategy, and product timing. Institutions that embed this level of responsiveness into their operating models are better positioned to preserve stability under stress.

Early Response Strategies

Proactive responses to macroeconomic signals can offer a significant advantage in rapidly changing markets. When indicators such as rising consumer confidence or credit expansion signal improved economic conditions, institutions that act early—whether through capital deployment, inventory adjustment, or resource reallocation—can secure a stronger market position.

For example, launching a product line in anticipation of increased consumer spending reflects a data-informed approach to market timing. This is not speculative—it is the result of aligning operational execution with credible macroeconomic insight.

Early response strategies, when structured and evidence-based, enhance competitiveness and allow firms to lead market shifts rather than react to them. Translating economic signals into preemptive action enables institutions to influence outcomes rather than simply adapt to them.

Practical Applications of Economic Analysis

The value of macroeconomic analysis lies in its direct applicability to strategic business planning and institutional decision-making. Rather than remaining in the realm of abstract theory, economic indicators such as GDP growth, inflation, and employment trends provide actionable insights that help organizations evaluate risk, allocate capital, and position for long-term resilience.

By systematically evaluating these indicators, institutions can forecast shifts in consumer behavior, identify structural changes in demand, and align their strategies with evolving macroeconomic conditions. This data-driven approach enhances both operational alignment and strategic foresight.

Diversification Strategy

Macroeconomic forecasting plays a critical role in supporting portfolio diversification strategies. By identifying sectors or regions with favorable growth outlooks, organizations can allocate resources more effectively—reducing exposure to underperforming segments and enhancing overall portfolio resilience.

During sector-specific downturns, diversified holdings across non-correlated markets allow firms to mitigate downside risk while capturing upside potential in more stable or expanding areas. This approach is particularly vital for institutional investors and corporate strategists seeking to maintain performance consistency amid macroeconomic volatility.

Additionally, economic indicators support robust scenario planning. By modeling different outcomes based on plausible shifts in inflation, interest rates, or consumption trends, firms can preemptively adjust marketing initiatives, production levels, and investment priorities. The objective is not just to react to changes but to institutionalize foresight as a competitive advantage.

Overcoming Challenges in Using Economic Data

One of the foremost challenges in applying macroeconomic data effectively is ensuring data reliability. Discrepancies between sources can create conflicting signals that undermine decision-making and increase strategic risk.

A best practice is to cross-reference data from established, authoritative institutions such as the Federal Reserve and the Bureau of Economic Analysis (BEA). Complementing these sources with independent, forward-looking research, such as that provided by Rosenberg Research, can further enhance data accuracy and confidence.

However, even highly credible sources can suffer from time lags. When market conditions shift rapidly, reliance on historical economic indicators may delay critical responses. This lag can hinder agility, leaving institutions at a disadvantage in dynamic environments.

Mitigating this limitation requires integrating real-time market data and alternative analytics, including sentiment analysis and consumer behavior tracking. These tools offer timely insights into evolving preferences and demand patterns—essential inputs for effective risk management and strategic adjustment.

Demographic Influences

Economic behavior is also shaped by demographic changes. An aging population, for example, influences spending patterns and market demand, creating what is often described as the “silver economy.” Institutions must anticipate these shifts and adjust strategies accordingly, whether through targeted product development or service design that addresses accessibility and engagement for older cohorts.

Proactively incorporating demographic analysis into macroeconomic frameworks strengthens the ability to forecast demand trends and optimize capital allocation in a changing societal landscape.

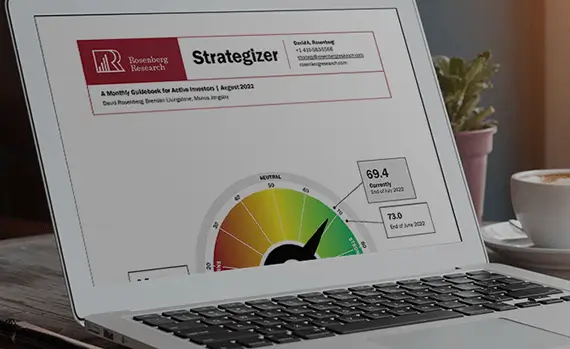

Try Rosenberg Research Free Trial.

Rosenberg Research delivers independent, rigorously analyzed macroeconomic insights tailored for institutional investors and financial professionals. To experience how our forward-looking intelligence can enhance your strategic decision-making and risk management, we invite you to start a free trial of our research platform.

Gain access to in-depth reports, data-driven forecasts, and expert analysis designed to empower advisors of advisors navigating complex market conditions.