In today’s dynamic economic environment, businesses that incorporate macroeconomic insights into their decision-making processes are better equipped to mitigate risk and capitalize on emerging opportunities. Rather than relying on reactive tactics, companies can use data-driven analysis of key indicators—such as GDP, inflation, interest rates, and labor trends—to guide strategic planning with clarity and confidence.

For instance, identifying early signs of a cyclical slowdown may inform decisions to delay capital expenditures, reassess pricing strategies, or adjust hiring plans. Conversely, recognizing conditions that signal expansion—such as improved consumer sentiment or easing monetary policy—can provide a roadmap for scaling operations or entering new markets.

This article explores how macroeconomic analysis can sharpen business strategy, align investments with economic trends, and support long-term resilience. By understanding the broader forces that shape demand, input costs, and financial risk, organizations can move beyond short-term guesswork and build strategies grounded in evidence and foresight.

Integrating Macroeconomic Analysis in Business Strategy

For today’s businesses, strategic agility depends on more than operational efficiency—it requires alignment with the broader economic environment. Macroeconomic analysis equips business leaders with the foresight needed to anticipate shifts in demand, pricing pressures, and investment risks. By systematically tracking indicators such as GDP growth, inflation, and unemployment rates, companies can embed forward-looking intelligence into their decision-making processes.

Rather than reacting to market conditions, organizations that integrate economic data into their planning cycles can take proactive steps—investing, reallocating resources, or adjusting pricing—based on credible signals, not speculation. For instance, a projected GDP upswing may signal the right environment for expansion, while a persistent inflation trend might trigger a reassessment of capital-intensive initiatives.

A Structured Approach to Integration

Step 1: Identify Relevant Economic Indicators

Begin by determining which macroeconomic indicators most closely influence your sector. For retail, that might mean monitoring consumer confidence and disposable income metrics. Manufacturers, on the other hand, may be more attuned to producer price indexes and industrial output. Platforms like FRED (Federal Reserve Economic Data) offer valuable tools for accessing and tracking these metrics in real time.

Step 2: Analyze Historical Correlations

Once relevant indicators are identified, examine how past shifts in these variables aligned with your business performance. Did rising unemployment coincide with slower sales? Was margin compression more severe during periods of high inflation? Establishing these correlations helps contextualize current data and refine strategic assumptions.

Step 3: Translate Insights into Strategy

With this contextual foundation, businesses can build adaptive strategies tailored to future scenarios. Anticipating interest rate hikes, for example, may lead to prioritizing cash flow preservation or reducing reliance on variable-rate financing. This kind of strategic foresight enhances resilience and positions the business to act—not just react—as conditions evolve.

Macroeconomic integration is not a one-time initiative. It’s an ongoing discipline that allows businesses to remain nimble amid uncertainty. As fiscal and monetary policies shift, so too must internal assumptions and strategic priorities. A consistent feedback loop between market data and business operations ensures alignment and drives performance in both stable and volatile economic environments.

As we move forward, we’ll examine how recent developments in inflation and labor dynamics are shaping near-term planning across industries.

Key Economic Indicators: Inflation, Interest Rates, and Employment Trends

Macroeconomic strategy begins with monitoring the indicators that shape market behavior—and inflation, interest rates, and employment trends remain front and center.

Inflation

Inflation reflects the pace at which prices rise across the economy and serves as a critical signal for both monetary policy and business planning. As of March 2025, the U.S. annual inflation rate sits at 2.4%, trending downward from 2.8% earlier in the year. This marks a sustained deceleration from its 2022 peak of 6.8%, when persistent supply-side constraints and policy lags drove broader price instability.

For businesses, these shifts carry immediate implications. Elevated inflation compresses margins, erodes consumer spending power, and increases input costs. Conversely, a stabilizing rate—such as the 2.9% annual average seen in 2024—can support more predictable cost structures and pricing strategies. Monitoring inflation trends enables forward-looking firms to recalibrate revenue models, renegotiate supply contracts, and manage customer expectations with greater precision.

Interest Rates

Closely linked to inflation is interest rate policy—arguably one of the most influential levers central banks use to regulate economic activity. Lower interest rates typically encourage borrowing, capital investment, and consumer spending. Rising rates, on the other hand, temper growth by increasing the cost of credit and reducing liquidity in the system.

In 2025, rate expectations remain fluid as the Federal Reserve balances economic expansion with inflation containment. For companies engaged in capital-intensive planning or refinancing, interest rate shifts affect borrowing costs, debt servicing, and long-term investment returns. Understanding these dynamics allows for timely adjustments in cash flow modeling and investment horizon planning.

Employment Trends

Labor market data offers real-time insight into economic strength and consumer demand. A declining unemployment rate—such as the U.S. figure dropping to 3.5% in April 2025—typically suggests robust hiring and wage growth, both of which can support spending and bolster revenue across sectors. However, analysts must look beneath headline figures. Stagnant wage growth or rising part-time employment, for example, may reveal latent weaknesses that temper optimism.

Taken together, these indicators do more than reflect conditions—they shape them. Inflation pressures influence rate policy; employment levels guide demand forecasts. For financial professionals, staying ahead of these signals is essential to anticipating market shifts and adjusting strategy accordingly.

Benefits of Utilizing Macroeconomic Insights

Leveraging macroeconomic insights can profoundly impact an organization’s ability to navigate the complex waters of today’s marketplace. First and foremost, these insights enable businesses to make informed decisions. By monitoring key indicators like GDP growth and inflation rates, companies can tailor their strategies to align with economic conditions.

For instance, if economic forecasts predict a slowdown, a business might choose to tighten its budget or pause expansion plans. This level of foresight allows firms to adapt rather than react, giving them a competitive edge.

Some might argue that relying too heavily on macroeconomic data can lead to overcautious decision-making. However, it’s essential to strike a balance. Rather than dictating every movement, macroeconomic trends should serve as a guiding compass for strategic planning. Just as sailors use weather patterns to adjust their sails, entrepreneurs can use economic signals to steer their ventures toward success.

Another critical benefit is the improvement in risk management. When companies understand the broader economic landscape, they can identify potential downturns before they impact operations. A retail company might notice rising unemployment figures—an early warning signal of decreased consumer spending—and adjust their marketing strategies accordingly. Those quick adaptations often translate into fewer losses during tough times.

Moreover, macroeconomic insights also enhance strategic initiatives. They allow businesses to gauge when to invest or divest in specific sectors based on prevailing conditions. For example, during periods of low interest rates, financing expansion becomes cheaper, making it an opportune time for investment. On the flip side, high inflation might prompt companies to reassess pricing strategies and cost structures.

In any industry—be it technology, manufacturing, or real estate—understanding these macro trends empowers businesses to act proactively rather than reactively. Geographical factors also come into play here; areas experiencing population growth can indicate investment opportunities that are likely underestimated by competitors who aren’t paying attention to these insights.

By effectively incorporating these insights into their operations, businesses set themselves up for long-term success. As we shift our focus now, examining how this knowledge informs future endeavors will prove instrumental for any organization aiming for resilience and adaptability.

Strategic Planning and Risk Management

Understanding macroeconomic signals is like having an early warning system for your business. When you pay attention to economic forecasts and key indicators—such as GDP growth, unemployment rates, and interest rates—you can steer your company more effectively through rough waters. For instance, if you anticipate an economic downturn, you can pivot your strategy toward products or services that typically remain stable during recessions. This means staying one step ahead of potential threats and safeguarding your operations.

The first step in strategic planning is identifying risks. Map out the potential threats your business might face by analyzing current economic conditions. For example, rising interest rates could affect consumer financing or increase operational costs, while declining consumer confidence could reduce demand for non-essential goods. By compiling a list of these potential issues based on prevailing macroeconomic indicators, you empower yourself with the knowledge necessary for resilience.

Once you’ve assessed the risks, the next crucial step involves formulating contingency plans.

Creating contingency plans is akin to preparing a safety net. Develop specific responses for various scenarios that may unfold due to economic fluctuations. For example, if unemployment rises and your sales take a hit, strategies could include offering discounts to stimulate demand or reallocating resources towards more profitable items. Such preparedness allows you to respond quickly without wasting time debating what actions to take when you’re already faced with challenges.

It’s important not just to plan but also to stay agile as conditions change.

Continuous monitoring and adjustment are vital components of strategic planning in a macroeconomic context. Keep an eye on economic indicators that resonate with your business operations—these insights should inform how you tweak your strategies over time. Utilizing market analysis tools such as stock indexes or loan origination volumes can help gauge the health of the economy and its implications for your sector.

Establish regular reviews of your risk assessments and contingency plans; think of it as an ongoing conversation rather than a one-time event. This ensures that you’re always aligned with current realities and positioned to seize opportunities as they arise.

With these strategies in place, businesses can navigate changes more effectively and turn challenges into competitive advantages while adapting to new economic landscapes.

Strengthen Business Strategy with Expert Economic Insights

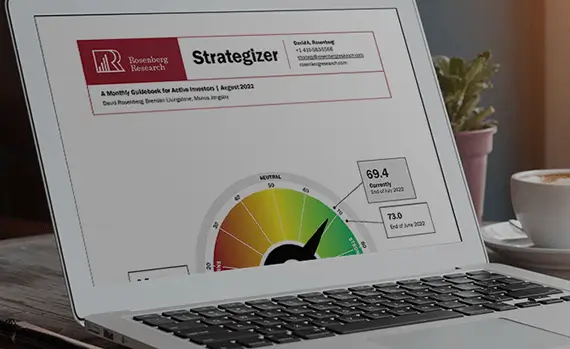

In a competitive business environment, timing and clarity matter. At Rosenberg Research, our independent economic analysis helps businesses stay ahead of market shifts by providing clear, actionable insights grounded in data—not noise.

From inflation and interest rate movements to labor market dynamics and fiscal policy trends, our research supports smarter planning across operations, investments, and resource management. Whether you’re navigating uncertainty or evaluating your next move, we help you make decisions with confidence.

Start your free trial today and discover how strategic insight drives stronger outcomes.